Global Anti-Money Laundering (AML) Online Training Courses

A global issue, money laundering is a federal crime with significant consequences. Educating teams on what it is, how to spot it, and how to prevent it helps protect your organization and employees.

Better everyday decisions

Employees come away with an understanding of Know Your Customer procedures and anti-money laundering laws that give them the knowledge to identify and handle serious crimes.

This course covers these topics and more:

- What is money laundering?

- The 3 stages of money laundering

- Key players in the US, UK, EU and International

- Overview of key AML laws

- Know Your Customer (KYC) procedures

- Spotting potential problems and red flags

- Taking action

Overview

How Can Global AML Training Help Your Business?

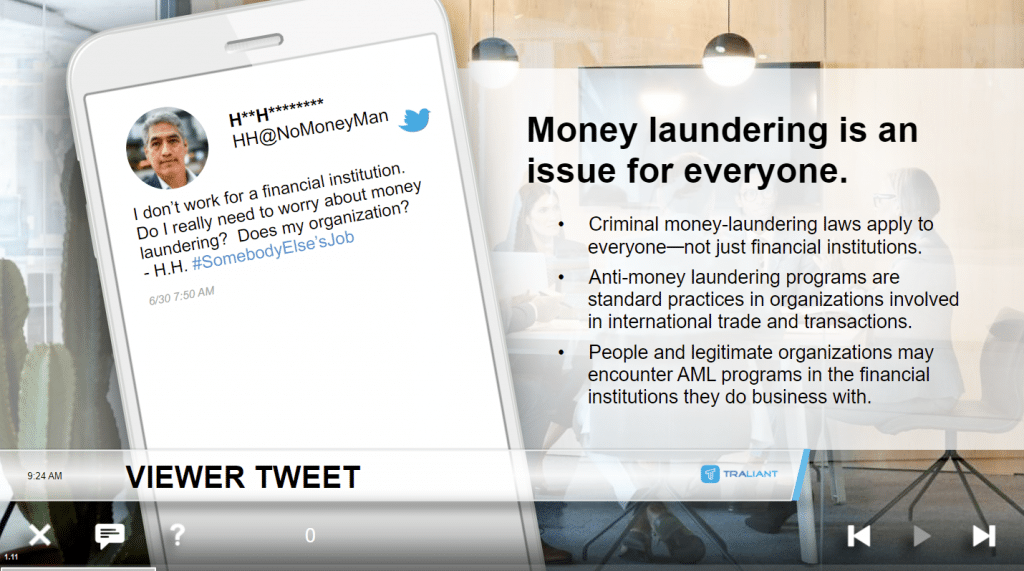

Global Anti-money laundering (AML) training is one of the key steps organizations can take to manage AML risk and reinforce a culture of ethics and compliance. Money laundering is a serious financial crime in which ‘dirty money’ from illegal activities, such as terrorist financing, is disguised to look like it comes from legitimate, ‘clean’ sources. In this way, criminals are able to conceal the source of their illicit funds from law enforcement. It’s estimated that $2 trillion is illegally laundered around the world and used to fund criminal activity.

While AML is a top priority for financial services companies, the consequences of money laundering and financial crime affect many other organizations and industries, in such areas as health care fraud, human trafficking, international and domestic public corruption, drug trafficking and terrorism.

Implementing AML policies, systems, procedures and ongoing training for frontline employees are essential elements in creating a robust AML program, complying with regulations and avoiding the financial and reputational costs of money laundering.

Online Training

Discover the Benefits of Our Global AML Training

This 35-minute course introduces employees and managers to the basics of global anti-money laundering. This course highlights common money laundering schemes, along with strategies for detecting, preventing and reporting suspicious activities. A variety of eLearning challenges reinforce AML concepts and boost engagement and knowledge retention.

The Traliant difference

Our modern, interactive approach to online compliance training is designed to help organizations create a safe, ethical and inclusive work culture. Traliant courses are mobile-optimized for access on any device and can be easily customized to reflect your organization’s policies, culture, branding and leadership message.

Learn more about our training methodologyYou may be interested in other courses from the same topic

Corporate Compliance and Ethics

11 courses

Connecting employees to your core values.

11 courses

Preventing workplace crimes requires education, awareness, understanding, and caution. Preparing teams with this knowledge safeguards their livelihoods and your organization’s reputation.

Help your employees make the right decisions, at the right moments